ad valorem tax florida real estate

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. The ad valorem tax roll consists of real estate taxes tangible personal property taxes and railroad taxes.

Disabled Veterans Property Tax Exemptions By State

For instance the US.

. County and municipal governments as well as local taxing authorities such as the School Board and South Florida Water Management District Childrens Trust determine tax rates also. The statutory deadline for filing a timely exemption application is March 1. PDF 8 KB DR-528.

Tax Roll Index R. Understanding the procedures regarding property taxes can save you money and will help this office to better serve you. Non-ad valorem assessments are fees for specific services such as solid waste disposal water management sewer storm water and special improvements.

The millage or rate of taxation is set by the Board of County Commissioners School Board City Council and. Those in the 62-64 age range may also claim additional ad valorem tax exemptions for educational purposes which are also subject to income restrictions. The tax roll describes each non-ad valorem assessment included on the property tax notice bill.

The Real Estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. PDF 281 KB DR-593. Utilization of the search facility indicates understanding and acceptance of this statement by the user.

It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. Efficiency improvement and renewable energy improvement. Real Estate Property Taxes.

Florida law provides for a number of ad valorem property tax exemptions which will reduce the taxable value of a property. The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of delinquency. PDF 9 KB DR-521.

Ad Valorem taxes are based on the assessed value and the millage of each taxing authority. This financing is most commonly known as PACE Property Assessed Clean Energy financing. Tax Collectors Report on Non-Ad Valorem Assessments Collected on the Notice of Taxes R.

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount. In cases where the property owner pays their real estate taxes through an escrow. We appreciate your cooperation and understanding as we navigate these challenging times.

Under Florida Statute 197 the Seminole County Tax Collector has the responsibility for the collection of ad valorem taxes and nonad valorem tax assessments. The property appraiser assesses the value of a property and the Board of County Commissioners and other levying bodies set the millage rates. Ad valorem taxes paid by a tenant qualify as rent and are taxable.

Federal estate tax is an ad valorem tax on the value of the estate but is levied progressively. The local government is able to levy non-ad valorem assessments to the property owner to fund such improvements. The tax certificates face amount consists of the sum of the following.

Copies of the non-ad valorem tax roll and summary report are due December 15. The real estate tax bill is a combined notice of ad-valorem taxes and non ad-valorem assessments. 17 It is irrelevant whether the property taxes are paid by a tenant either directly to the landlord as part of CAM as a reimbursement to the landlord or directly to the relevant tax collector.

A floating inflation-proof exemption similar to the assessed value increase caps in Florida is available to those 62 and older for their Georgia home that has increased in value more than 10000. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property. REAL ESTATE AD VALOREM TAXES.

Applicants who fail to apply timely may still file an application on or before the 25th day following the. Non-ad valorem fees can become a lien against a property whether homesteaded or not. Ad Valorem is a Latin phrase meaning According to the worth.

These are levied by the county municipalities and various taxing authorities in the county. To renew your tags pay property taxes or business tax receipts simply click the appropriate link below or on our home page. The certificate holder is an independent investor who actually pays the tax for a property owner in.

The Santa Rosa County Tax Collector makes every effort to produce and publish the most current and accurate information possible. This information does not constitute a title search. Tax Roll Sheet Real and Personal Property R.

The most common real property exemption is the homestead exemption. No warranties expressed or implied are provided for the data herein its use or its interpretation. The tax certificate sale must be held 60 days after the date of delinquency or June 1 whichever is later per Florida Statute 197402.

Taxes are levied in Hillsborough County by the taxing authorities. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes. Non-ad valorem means special assessments and service charges not based upon the value of the property and millage.

Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis beginning on November 1 st for the tax year January through December. If you must visit the office in person an appointment is necessary. The Office of the Property Appraiser.

Florida statutes 197122. If you need to contact our call center please be patient as our call volume has increased. A Closer Look at Real Estate Riders Addenda and Disclosures Facebook.

Ad Valorem Taxes are based on the value of real property and are collected in arrears on an annual basis beginning on or before November 1st for the tax year January through December. Tax certificates convey no property rights. Ad valorem taxes are based on the value of property.

There are however ad valorem taxes that are only assessed at a certain value or higher. These are levied by the county municipalities and various taxing authorities in the county. When purchasing a property with a non-ad valorem be aware that the.

Upon completion the tax roll is then certified to the tax collector. A tax certificate is an enforceable first lien against the property for unpaid real estate property tax. A tax certificate is an interest bearing lien for unpaid real estate and non-ad valorem assessments.

Ad valorem and non ad valorem assessments are mailed on or before October 31 and due November 1. Non-Ad Valorem Taxes Non-ad valorem assessments are based on the improvement or service cost for a property example. As a property owner in Indian River County it pays to be informed about your rights and responsibilities under Florida law.

18 In these situations substance prevails over form and payment of ad valorem taxes is classified as consideration. PDF 88 KB XLS 82 KB DR-520A. The Tax Collector prints mails.

Ad-valorem taxes are based on. Taxes on all real estate property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

The Tax Collector consolidates the certified ad valorem and non ad valorem tax rolls and mails tax notices to the property owners last known address of record as it appears on the tax roll. Using these figures the property appraiser prepares the tax roll. All motor vehicles mobile homes and trailers in the state of Florida must be registered andor.

The real estate property tax notice also includes non-ad valorem assessments levied against the property for services such as solid waste fire rescue libraries and other special assessments. There are different types of non-ad valorem assessments that can appear on your TRIM Notice. Solid waste and fire rescue and are.

They are a first lien against property and supersede governmental liens. Ad Valorem taxes are collected on an annual basis beginning November 1st and are based on that calendar year from January 1st through December 31st. Ad valorem taxes are levied on real estate property and are based on the assessed value of the property established by the Lake County Property Appraisers Office.

The Property Appraisers Office establishes the assessed value of a property and the Board of County. Local taxing authorities set the respective millage rates. The Property Appraiser establishes the taxable value of real estate property.

This means there are higher percentages of tax owed depending on how much of the estates value is above the exemption rate which was. Notice of Ad Valorem Taxes and Non-Ad Valorem Assessments.

A Breakdown Of 2022 Property Tax By State

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

The Hidden Costs Of Owning A Home

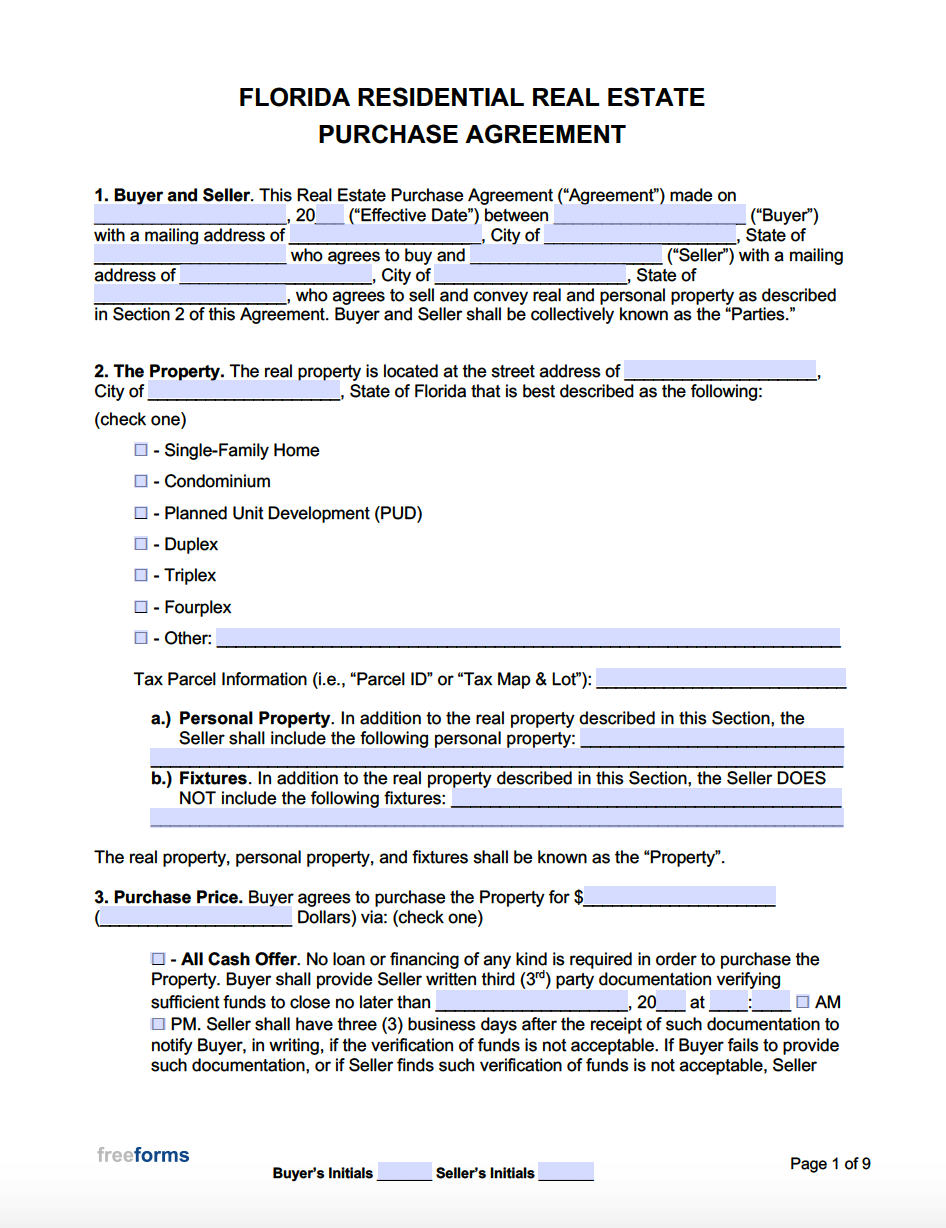

Free Florida Real Estate Purchase Agreement Template Pdf Word

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

Real Estate Property Tax Constitutional Tax Collector

Property Taxes Brevard County Tax Collector

Property Tax Information Palm Beach Fl Official Website

Desoto County Property Appraiser David A Williams Cfa Arcadia Florida 863 993 4866

Property Taxes How Much Are They In Different States Across The Us

Florida Property Tax H R Block

What Is A Homestead Exemption And How Does It Work Lendingtree

Real Estate Property Tax Constitutional Tax Collector

Property Tax Search Taxsys Broward County Records Taxes Treasury Div

What S My Property S Tax Identification Number

Property Tax Information Palm Beach Fl Official Website

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes