arizona residential solar energy tax credit

Equipment and property tax exemptions. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

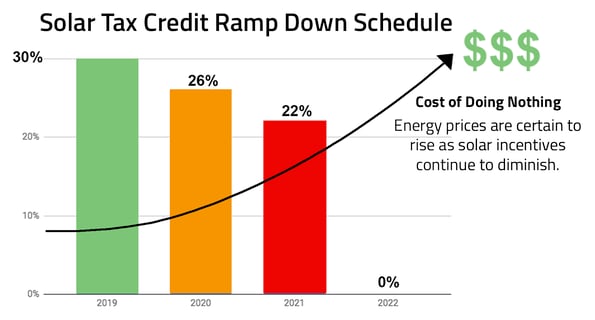

3 Solar Incentives To Take Advantage Of Before They Re Gone

41-151001 was established to.

. Discover Local Solar Pros In Arizona Today. The tax credit for wind and biomass systems equals 001 per kilowatt-hour kWh for the first 200000 megawatt-hours MWh of electricity produced in a calendar year for a period of ten years. After factoring in the federal investment tax credit ITC of 26 percent and additional state and municipal solar incentives the net cost of solar can be.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Top Solar Power Companies In Your Area. You can claim the credit for your primary residence vacation home and for either an existing structure or.

The federal government enacted the solar Investment Tax Credit ITC in 2006. The tax credit which may be applied against corporate or personal taxes is equal to 10 of the installed cost of qualified solar energy devices and applies to systems installed between January 1 2006 and December 31 2018. Ad Free Arizona Solar Quotes.

Arizona residential solar energy tax credit. The Renewable Energy Production Tax Credit is for production of electricity using qualified energy resources that is sold to an unrelated entity or public service corporation. In the years since the US.

An average solar installation in Arizona costs 10412 to 14088 with the average gross price for solar in Arizona being 12250 based on a solar panel system size of 5 kilowatts kW. The federal tax credit falls to 22 at the end of 2022. The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1000 maximum allowable limit regardless of the number of.

Arizona State Energy Tax Credits. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows.

Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. Arizona has a budget surplus. Industrial Solar Tax Credit.

When it comes to Arizonas solar energy existing financial incentives and policy only make it more lucrative for you to sustainably increase your property value. Lets support small- to medium-sized solar companies dedicated to training all levels of. The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a.

If another device is installed in a later year the cumulative credit cannot exceed 1000 for the same residence. May a taxpayer who rents take the solar energy credit for a solar. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.

An Arizona income tax credit is offered to businesses that install one or more solar energy devices in their Arizona facilities. Find Top Rated Solar Companies in Your Area. An income tax credit for the installation of solar energy devices in Arizona business facilities.

Az solar tax credit 2021 form. The average cost youre looking at for a residential solar system is 11160 to 46500. Solar water heating systems can receive a rebate of 050 per kilowatt-hour kWh of estimated energy savings in the first year.

13 hours agoDedicated tax credits for solar job training. Kansas solar panel cost. - For details about this credit please read the program guidelines first Note.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application. The CommercialIndustrial Solar Energy Tax Credit Program ARS.

The Arizona Department of Revenue ADOR is advising homeowners who installed solar energy devices in their homes throughout 2021 to submit Forms 310 and 301 to receive an income tax credit. Arizona solar incentives 2022. The Renewable Energy Production tax credit is for a.

The tax credit for photovoltaics PV and solar. Arizona solar program 2021. 42-5001 15 as a system or series of mechanisms designed.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation. Solar tax credits and. 23 rows A nonrefundable individual tax credit for an individual who installs a.

Sunday September 19 2021 - 1200. A solar energy device is defined by ARS. A taxpayer is eligible for the credit only for a solar energy device installed in the taxpayers residence located in Arizona.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Arizona Solar Energy equipment Whol - get access to a huge library of legal forms. Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax.

Free Online Solar Energy Installation Resource. Check Rebates Incentives. Arizona form 310 instructions.

Like the temporary Residential Renewable Energy Tax Credit which applies to up to 30 percent of your installation. No more than 20 million can be approved by the department in a calendar year. Can a taxpayer take the solar energy credit for solar energy devices installed on residential rental property owned by the taxpayer.

Find other Arizona solar and renewable energy rebates and incentives on Clean Energy Authority. Photovoltaic PV and wind energy systems 10 kilowatts kW or less can receive an upfront rebate of 005 per watt up to 500. Read Our Company Breakdowns.

Az solar tax credit form. Ad Calculate Your Cost To Go Solar. The maximum tax credit that can be claimed for a qualified system in any one year is 2 million.

Get Up To 4 Free Solar Quotes By Zip. The number one point homeowners want to consider is the cost of solar panelsSolar panels in Kansas can be incorporated into your budget in different ways including financing leasing or entering into a power purchase agreement. This is 26 off the entire cost of the system including equipment labor and permitting.

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. 026 18000 - 1000 4420. Check Our Easy-To-Read Rankings.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Solar industry has grown by more than 10000 with an average annual growth of 50 over. Get Pricing Calculate Savings.

Residential Solar and Wind Energy Systems Tax Credit. Ad Determine The Right Solar Power Company For You. Professionally drafted and regularly updated online templates.

Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive program for the State market.

Residential Energy Credit How It Works And How To Apply Marca

Solar Tax Benefits In Phoenix Arizona Solar Incentives

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

How To Take Advantage Of Solar Tax Credits Earth911

Solar Incentives Southface Solar Phoenix Az

Solar Panels Cost Arizona 2020 Cost Vs Savings

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Arizona Solar Tax Credits And Incentives Guide 2022

Is Solar Energy Expensive Energy Solution Providers Az

2022 Arizona Solar Incentives Tax Credits Rebates And More

Free Solar Panels Arizona What S The Catch How To Get

Is Solar In Arizona Actually Free

3 Solar Incentives To Take Advantage Of Before They Re Gone

Income Tax Credit For Residential Solar Devices Arizona Department Of Revenue Prescott Enews

Solar Tax Credit In 2021 Southface Solar Electric Az

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Is The Federal Tax Credit For Solar Panels Going Away In 2020